A Bearish Profit Strategy for Minimizing Risk

Introduction

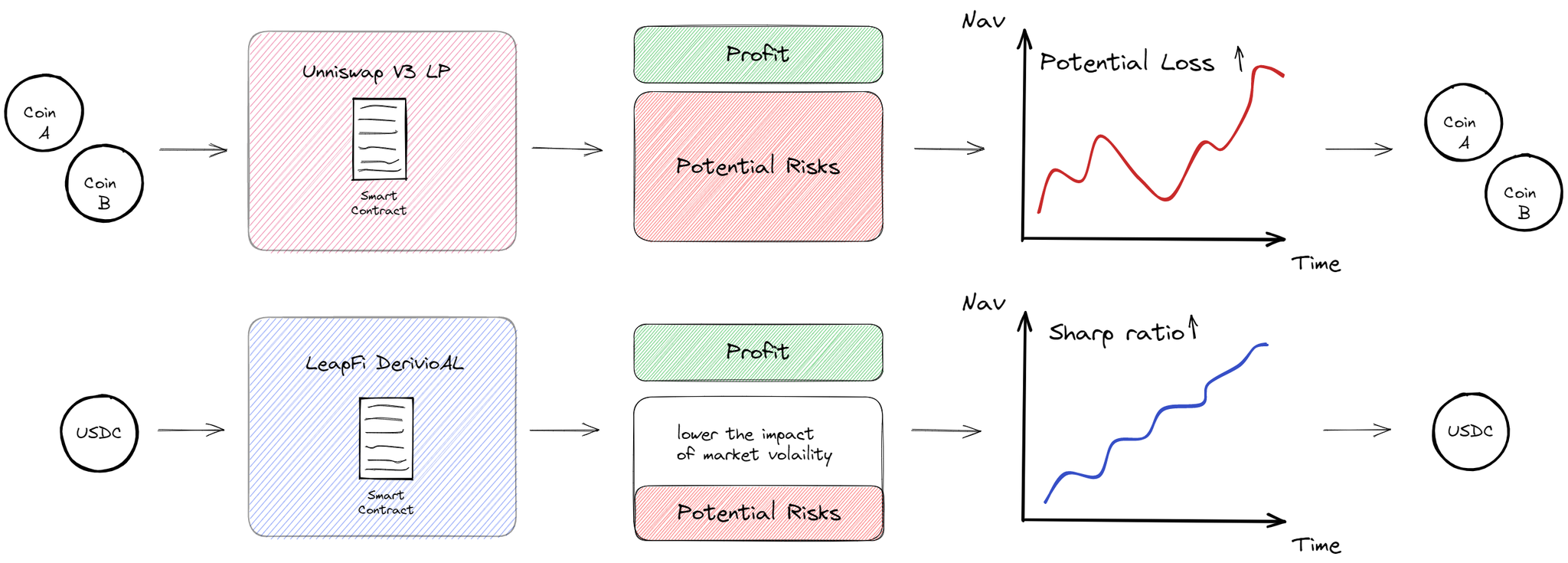

DerivioAL is a unique bearish profit strategy that allows users to lock in assets within a specific range during the opening period. This innovative strategy provides protection and generates cash flow over time, even if the underlying asset falls or does not rise. DerivioAL offers an automatic stop-loss mechanism to protect users' interests, making it a low-risk, high-yield investment option.

Key Features

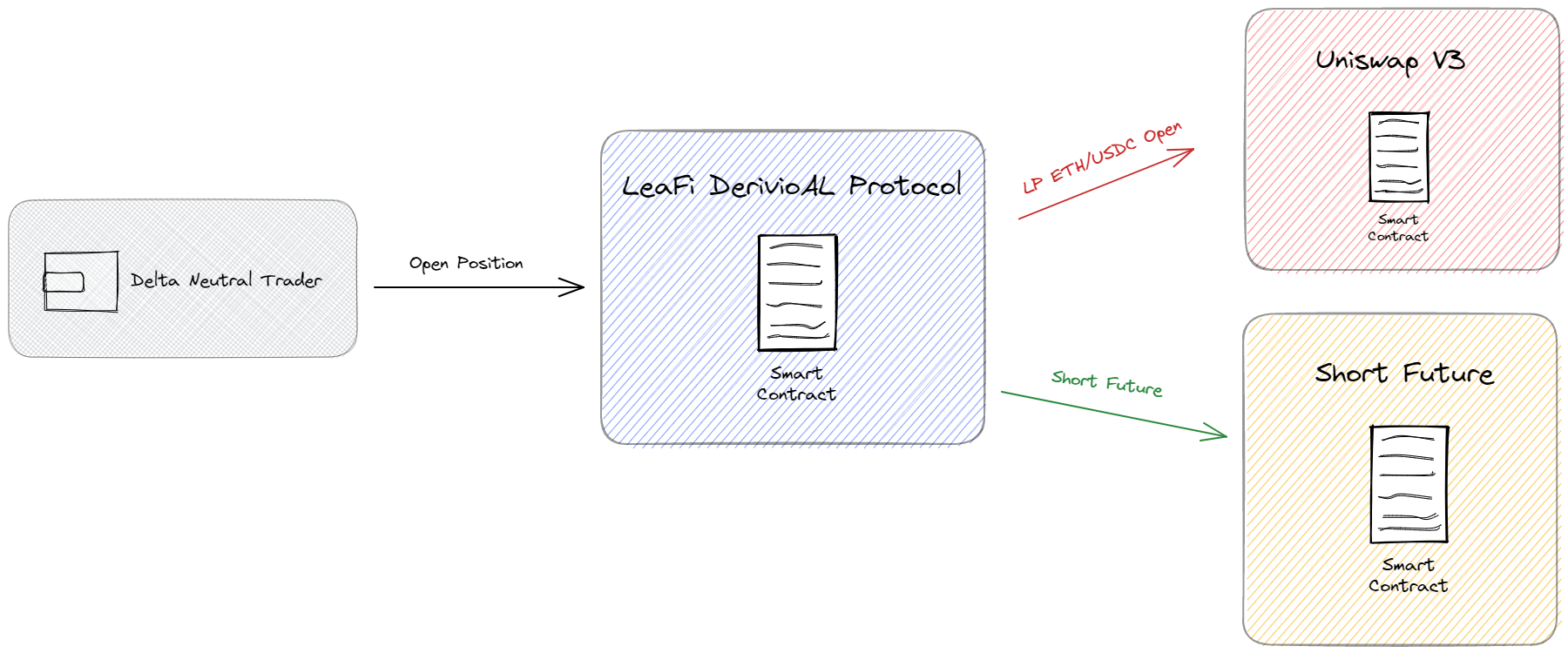

DerivioAL utilizes liquidity on Uniswap v3 and futures on GMX to hedge risk and complete a non-linear bearish profit strategy. This allows users to:

- Reverse LP downside risk

- Only earn swap fees without bearing the potential loss of assets

- Have left hand LP and right hand hedge

- Execute the strategy with a simple, elegant, one-click process

- Process everything in USDC

- Process everything in DeFi

In addition, DerivioAL provides auxiliary tools such as automatic stop-loss, take-profit, breakeven, and trailing stop to assist users.

How it Works

DerivioAL offers a unique approach to hedging risk and generating profits. By using short futures as a leg two hedge, DerivioAL can help users minimize risk and earn revenue even when the price of the underlying asset falls.

DerivioAL is suitable for users who want to minimize risk and believe that the underlying asset will fall or remain in a consolidation range. It is also suitable for users who buy and hold the underlying asset. DerivioAL can effectively help users continuously earn profits when the price falls, waiting for the price to rise again.