A Profitable Strategy for Betting on Market Downturns

Introduction

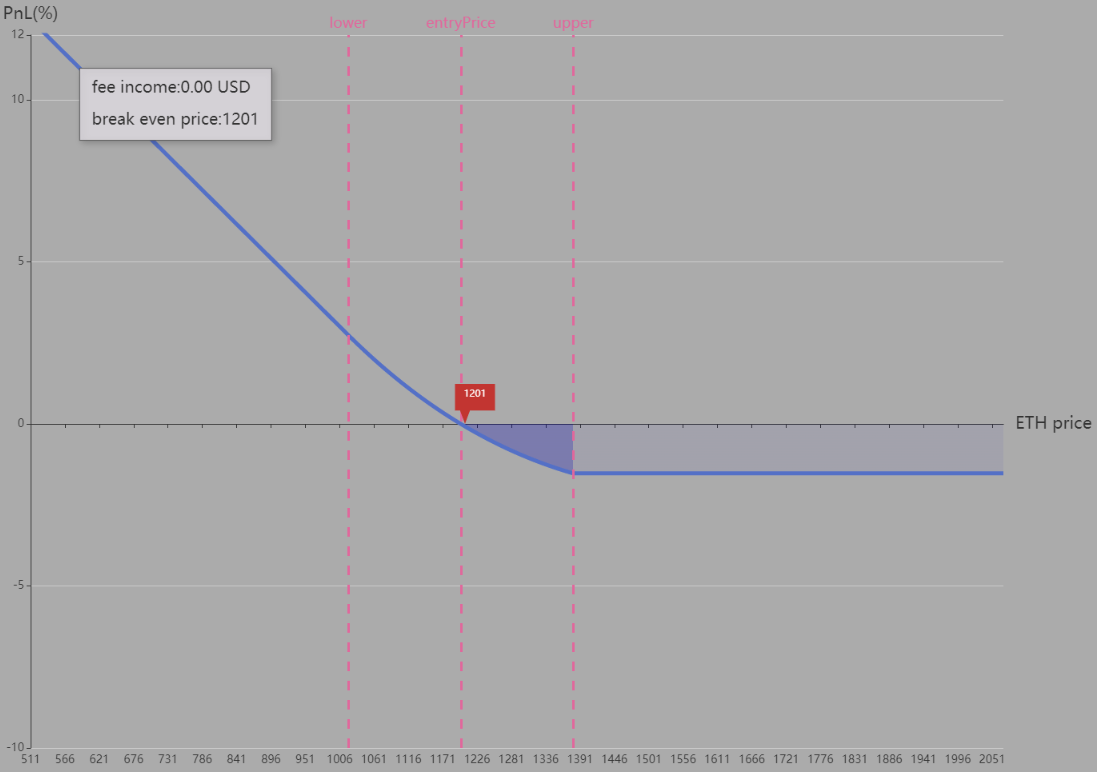

DerivioVS is a profitable strategy that allows users to bet on a market downturn to earn amazing returns at a very low cost when the underlying asset falls. The more it falls, the more they earn, as long as the asset does not go to zero.

Key Features

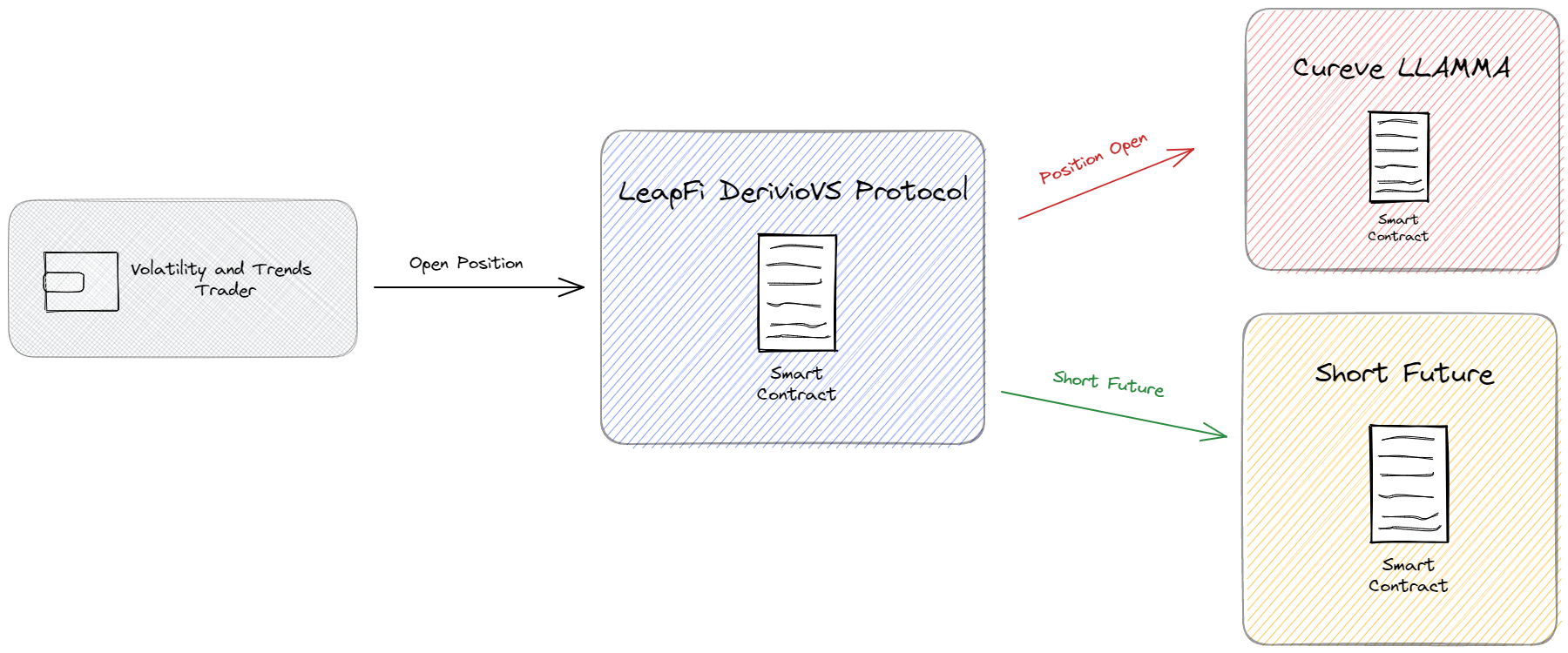

DerivioVS creates a non-linear bearish strategy by establishing positions on the LLAMA protocol on Curve and hedging with GMX futures.This allows users to:

- Flip the upside profit to downside by Hedging

- Left-hand curve’s lending and right-hand hedge

- Execute the strategy with a simple, elegant, one-click process

- Users can earn LeapFi tokens as a reward

- Process everything in USDC

- Process everything in DeFi

In addition, DerivioVS provides auxiliary tools such as automatic stop-loss, take-profit, breakeven, and trailing stop to assist users.

How it Works

DerivioVS is best used when investors anticipate a significant market downturn. This strategy can help investors reduce risk and protect existing portfolios. In addition to actively using DerivioVS to profit from falling assets, you can also use DerivioVS as a hedge for target assets to protect your investment positions from market volatility.