A Bullish Profit Strategy for optimizing yield

Introduction

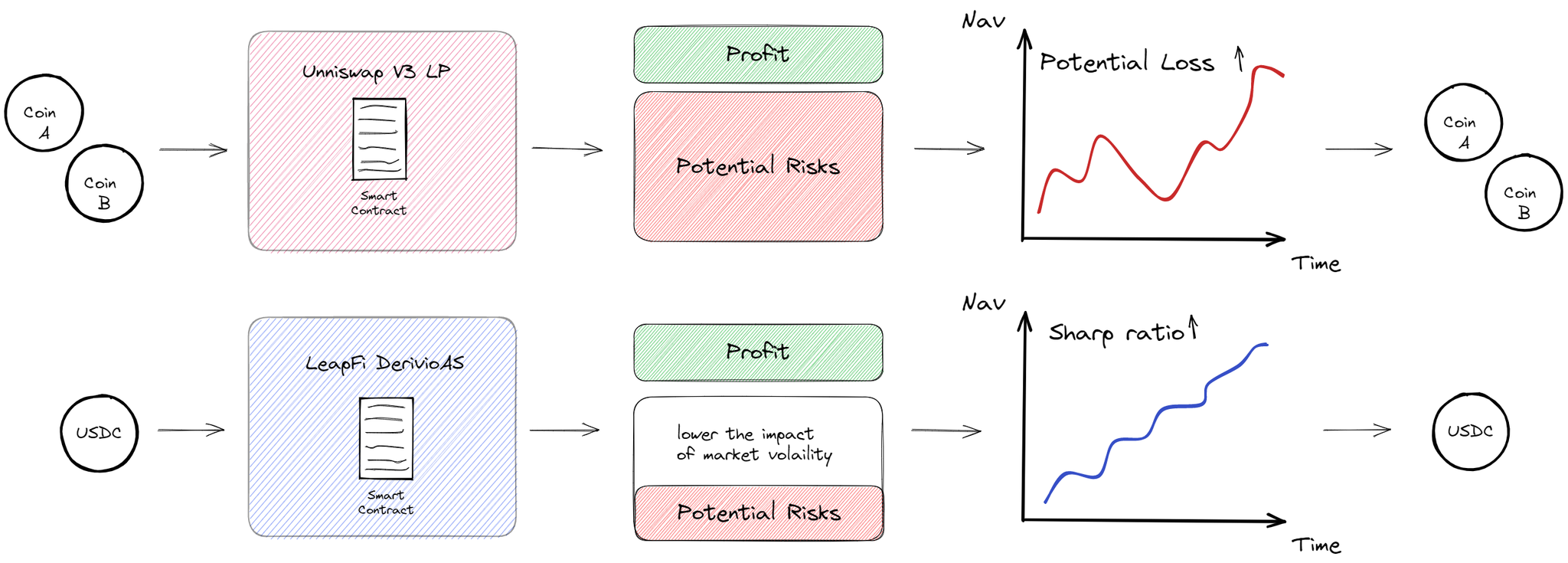

DerivioAS is a bullish profit strategy that is optimized through the LeapFi protocol, allowing users to become liquidity providers in the Uniswap v3 pool and earn trading fee profits. With just one click, users can lock in assets during the opening period within a specific range, providing protection and generating cash flow over time.

DerivioAS is designed to offer lower risk and more yield, making it suitable for users who want to minimize risk and believe that the underlying asset will rise or remain in a consolidation range. It is also suitable for users who hold the underlying asset and are ready to exit. DerivioAS can efficiently earn interval profits and obtain steady profits when the underlying asset rises.

Key Features

DerivioAS, optimized through the LeapFi protocol, helps users become liquidity providers in the Uniswap v3 pool and earn trading fee profits.Thit allows users to:

- Enjoy all the advantages of Uniswap v3 LP

- Automatically plan the best market-making range

- Save the hassle and cost of exchanging two market-making currencies

- Users can earn LeapFi tokens as a reward

- Process everything in USDC

- Process everything in DeFi

DerivioAS provides auxiliary tools such as automatic stop-loss, take-profit, breakeven, and trailing stop to assist users.

How it Works

DerivioAS is suitable for users who want to minimize risk and believe that the underlying asset will rise or remain in a consolidation range. At the same time, It is also suitable for users who hold the underlying asset and are ready to exit. DerivioAS can efficiently earn interval profits and obtain steady profits when the underlying asset rises.